puerto rico tax incentives act 22

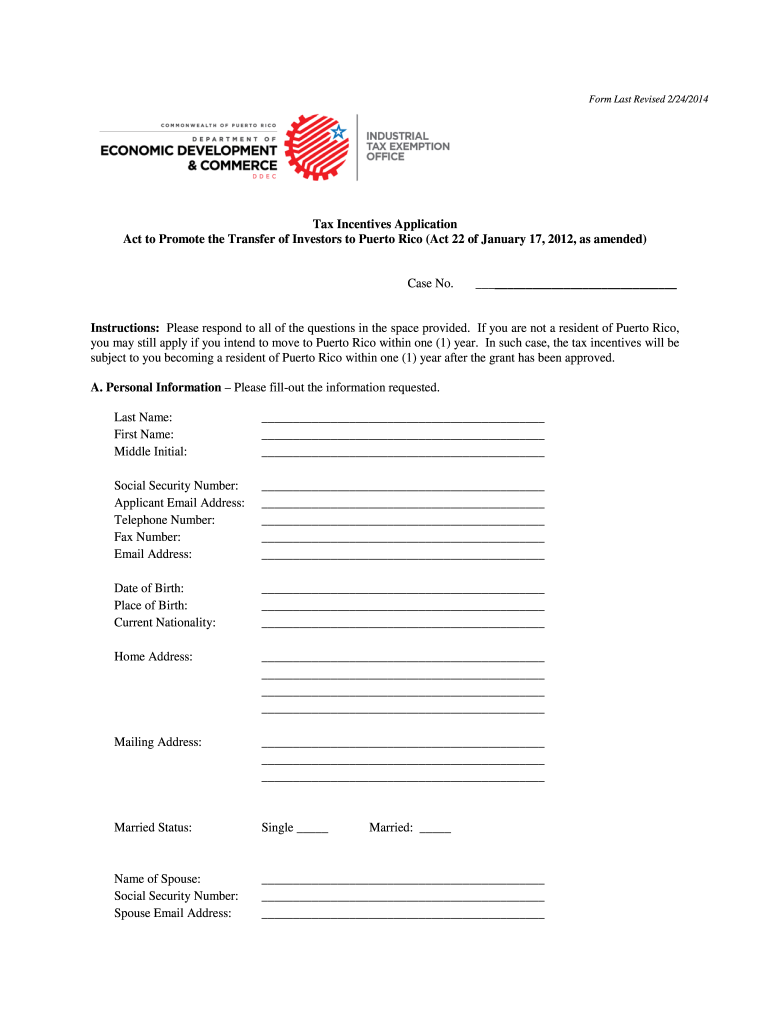

Citizens that become residents of Puerto Rico. With the tax incentives overhaul of 2019 a couple of new requirements were added to Act 22 beginning in January of 2020.

Act 22 Individual Investors Puerto Rico Tax Incentives

If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investorsIn a recent attempt to strengthen its economy and attract investors the local government has stepped up its economic and tax incentives for those wanting to do business.

. Act 20 and 22 tax incentives have been replaced by Act 60 as of January 1 2020. Puerto Rico Tax Act 60 Business Opportunities And Tax Incentives In The Caribbean. Puerto Rico Tax Incentives.

Changes to Act 2022 New Incentives Code of Puerto Rico for Jan 1 2020. Learn More LEARN MORE ABOUT THE BENEFITS OF ACT 60 AND ITS INCENTIVE PROGRAMS Contact. In January of 2012 Puerto Rico passed legislation making it a tax haven for US.

In addition to Act 20 Puerto Rico also passed Act 22 known as the Individual Investors Act so as to attract wealthy individual investors to relocate to the Island. Under Act 22 bona fide residents of Puerto Rico who qualify can completely eliminate capital gains tax with a 100 tax exemption on assets acquired after the applicant has. In Puerto Rico with local or non-local capital to export services at a preferential tax rate among other benefits.

Of particular interest are Chapter 2 of Act 60 for Resident Individual Investors and Chapter 3 for Export Services which shield new residents who live in Puerto Rico for at least half the year from paying. 22 of 2012 as amended known as the Individual Investors Act the Act. The new law does NOT eliminate the existing incentives.

Both laws aim to provide attractive incentives to encourage investors to relocate to Puerto Rico while also. Along with the long-standing bona fide residence requirement the Puerto Rico housing incentive act now requires you to now buy a home and make a qualifying donation to a local Puerto Rican charity. Since Act 22 was passed there are fewer tax returns filed at the Treasury Department from beneficiaries than decrees granted so far.

For taxable year 2019 the Puerto Rico Treasury Department received 1044 returns from individuals who had the incentive. The tax laws known as Act 20 the Export Services Act and Act 22 the Individual Investors Act shields new residents residing in Puerto Rico for at least half of the year from. Act 22 - Puerto Rico Tax Incentives To Business Owners And Investors Puerto Rico Tax Act 22.

Social media groups the tax code the history of Puerto Rico Act 20 and Act 22 or industry white papers. Citizens that become residents of Puerto Rico. It systematizes dozens of incentive acts Acts 20 and 22 are just the most famous ones that Puerto Rico has enacted over the years.

On July 1 2019 Puerto Rico enacted legislation providing tax incentives for US. Additional personal state programs extra. The Act provides tax exemptions to eligible individuals residing in Puerto Rico.

4 corporate tax rate for Puerto Rico services companies. On January 17 2012 Puerto Rico enacted Act No. ACT 20 ACT 22 Act 22 provides an opportunity for individuals who.

The various Puerto Rico tax incentive laws and their interrelationship with the United States federal tax laws are also covered. The New Incentives Code allows for the companys operation and service deliverybe performed from and outside Puerto Rico. Make Puerto Rico Your New Home.

In late June 2019 Puerto Rico completed a massive overhaul of their tax incentives enacting the Incentives Code. Prepared memos and tax related opinions completed tax exemption applications. If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investorsIn a recent attempt to strengthen its economy and attract investors the local government has stepped up its economic and tax incentives for those wanting to do business here.

Prepared closing agreements for clients with the Puerto. The most famous are Act 20 and Act 22now the Export Services and the Individual Resident Investor tax incentives respectively under the newly enacted Act 60but Puerto Rico offers various other tax incentives that may fit your needs. Along with Puerto Rico Tax Act 20 Puerto Rico adopted an additional incentive the Act to Promote the Relocation of Individual Investors Puerto Rico Tax Act 22 to stimulate economic development by offering nonresident individuals 100 tax exemptions on all interest all.

Incentives laws including Act 20 Act 22 Act 273 Act 83 Act 74 and Act 27. The tax incentive program which was first created as the 2012 Act 20 and Act 22 programs could not have come at a better time as President Biden prepares to announce the largest federal tax hike since 1993. Act 20 and Act 22 were enacted in Puerto Rico in 2012 to promote the exportation of services by companies and individuals providing such services from Puerto Rico and the relocation of high-net-worth individuals to Puerto Rico.

Read our extensive list of Puerto Rico tax incentives to determine which is right for you. Tax returns vs. The DDEC had more than 2400 decrees in place then.

The Act may have profound implications for the continued economic recovery of Puerto Rico. To avail from such benefits an.

New Puerto Rico Act 20 22 Tax Incentive Calculator For Businesses And Investors

A Detailed Analysis Of Puerto Rico S Tax Incentive Programs Premier Offshore Company Services

Puerto Rico Tax Act 60 Business Opportunities And Tax Incentives In The Caribbean

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22

Puerto Rico Taxes How To Benefit From Incredible Tax Incentives Global Expat Advisors

Centro De Periodismo Investigativo Puerto Rico Act 22 Tax Incentive Fails Centro De Periodismo Investigativo

The Impacts Of Puerto Rico S Act 20 And Act 22

Puerto Rico Tax Incentives Act 20 Act 22

Gov T Revokes 121 Tax Incentives Decrees Under Act 22 News Is My Business

Centro De Periodismo Investigativo Acts 20 And 22 Created A Class Of Intermediaries Who Manage Tax Exemptions Centro De Periodismo Investigativo

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22

Guide To Income Tax In Puerto Rico

Act 22 Individual Investors Puerto Rico Tax Incentives

Tax Weary Americans Find Haven In Puerto Rico Frost Law Washington Dc

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Could Puerto Rico Be Your Crypto Tax Haven Gordon Law Group

A Red Card For Puerto Rico Tax Incentives Washington Dc Tax Law Attorney Montgomery County Irs Audit Lawyer

Relocate Puerto Rico Puerto Rico Tax Incentives Act 20 Act 22 Residency Facebook By Relocate Puerto Rico

Puerto Rico Application Act 22 Fill Online Printable Fillable Blank Pdffiller