child tax credit 2021 dates october

How did eligible individuals receive their advance Child Tax Credit payments. That means if a five-year-old turns six in 2021 the parents will receive a.

October Holidays 2021 Fun Unique Reasons To Celebrate So Festive National Holiday Calendar Holiday Calendar October Food

However for 2022 the credit has reverted back to 2000 per child with no monthly payments.

. As part of the American Rescue Act signed into law by President Joe Biden in March of 2021 the child tax credits were expanded to up to 3600 per child from the previous 2000. The Child Tax Credit has been expanded from 2000 per child annually up to as much as. From january to december 2022 taxpayers will continue.

To be eligible for the maximum credit taxpayers had to have an AGI of. Under the American Rescue Plan the maximum child tax credit rose to 3000 from 2000 per child for children ages 6 and older and it rose to 3600 from 2000 for children ages 5 and younger. Child Tax Credit 2022.

Wait 5 working days from the payment date to contact us. Updated May 20. For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to.

Below is the full list of 2021 child tax credit advance payment dates. The complete 2021 child tax credit payments schedule. IR-2021-153 July 15 2021.

December 13 2022 Havent received your payment. Parents of a child who ages out of an age bracket are paid the lesser amount. 5 July 15 2021.

From July to December of 2021 eligible families received up to 300 per child under six years old and 250 for children between the ages of six to 17. Includes related provincial and territorial programs. That means another payment is coming in about a week on Oct.

Get your advance payments total and number of qualifying children in your online account. October 20 2022. For now parents of about 60 million children will receive direct deposit payments on October 15 while some may receive the checks.

Treasury sends the first monthly round of CTC advance payments to families of more than 60 million children. The 2021 advance monthly child tax credit payments started automatically in July. As a result of the american rescue act the child tax credit was expanded to.

For each qualifying child age 5 and younger up to 1800 half the total will come in six 300. How Next Years Credit Could Be Different. 112500 or less for heads of household.

The 2021 child tax credit is available for parents and guardians with children who are under age 18 and have a Social Security number. While not everyone took advantage of the payments which started in July 2021 and ended in. Frequently asked questions about the 2021 Child Tax Credit and Advance Child Tax Credit Payments Topic E.

IR-2021-201 October 15 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their advance Child Tax Credit CTC payment for the month of October. The 500 nonrefundable Credit for Other Dependents amount has not changed. 3600 for children ages 5 and under at the end of 2021.

Around 36 million eligible American families will receive financial relief as part of the Child Tax Credit. Even though child tax credit payments are scheduled to arrive on certain dates you may not have gotten the money. These payments are.

For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per child for kids. 3000 for children ages 6 through 17 at the end of 2021. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing.

1 day agoChild tax credit payments will revert to 2000 this year for eligible taxpayers Credit. Congress fails to renew the advance Child Tax Credit. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

Payments will be made on the same date in November and December before the other half of the child tax credits will be distributed in April 2022. Goods and services tax harmonized sales tax GSTHST credit. 75000 or less for singles.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax Credit payments as direct deposits begin posting in bank accounts and checks arrive in mailboxes. The payment is 250 for a child from 6 years old to 17 years old or 300 for a child under 6 years of age. You will receive either 250 or 300 depending on the age of.

150000 or less for married couples filing a joint. Enter your information on Schedule 8812 Form. The Child Tax Credit Non-Filer Sign-Up Tool is to help parents of children born before 2021 who dont typically file taxes but qualify for advance Child Tax Credit payments.

That means parents. To reconcile advance payments on your 2021 return. Tax Refund Schedule 2022 If You Claim Child Tax Credits.

This first batch of advance monthly payments worth.

Tax Day Deadline In 3 Weeks What Happens If You File A Tax Extension Tax Extension Tax Refund Filing Taxes

Pin By Tax Consultancy On Tax Consultant Tax Deductions Bank Statement 1st Bank

Best Tax Free Bonds To Invest In 2020 Tax Free Bonds Tax Free Investing

Norway Servebolt High Performance Hosting Company Invoice Template In Word And Pdf Format Fully Editable Invoice Template Hosting Company Templates

Tds Due Dates Due Date Make It Simple Generation

7 Ways Fraudsters Reach Out To Rip You Off Bar Graphs Online Ads Graphing

Input Tax Credit Tax Credits Indirect Tax Tax Rules

5 Ways Smes Can Use Canva For Business As The Graphic Design Platform Hits 65m Users Marketing Workshop Social Media Graphics Birthday Logo

Gst Input Tax Credit Tax Credits Indirect Tax Tax Guide

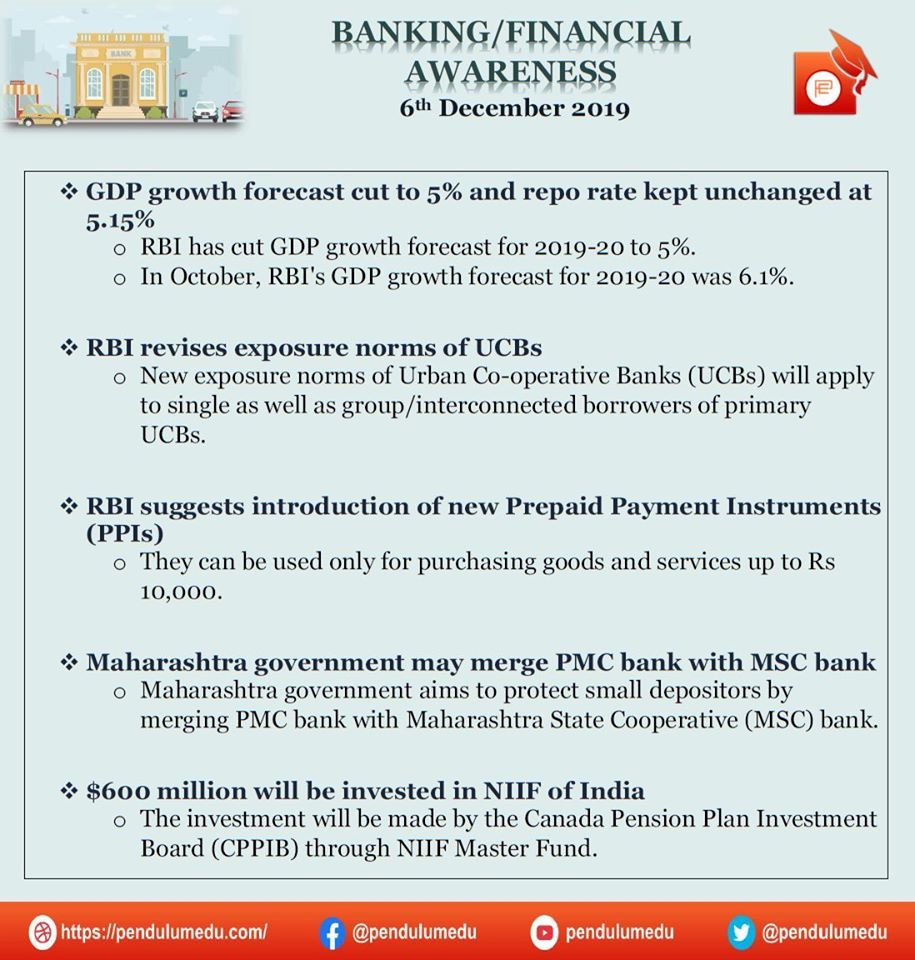

Daily Banking Awareness 06 December 2019 Awareness Financial Banking

Pdf Ebook South Western Federal Taxation 2021 Comprehensive 44th Edition By David M Maloney Ja Buy Ebook Ebook Online Taxes

Tds Due Dates October 2020 Dating Due Date Income Tax Return

Stimulus Checks 11 Must Know Facts To Clear Up The Confusion Taking Shape Bills Cnet

Tax Return Deadlines 2021 Tax Deadline Tax Return Deadline Tax Refund

Federal Income Tax Deadlines In 2022 Tax Deadline Income Tax Deadline Filing Taxes